Locate Your Perfect Car Insurance Strategy in Dallas

Variables to Look At Prior To Deciding On Car Insurance Policy in Dallas

When choosing car insurance policy in Dallas, there are a number of important elements to take into consideration if you want to find the finest insurance coverage for your needs. Among the key points to consider is examining your coverage demands based upon your steering habits, the value of your vehicle, and any kind of possible risks you may experience on the road. It is necessary to understand the different kinds of car insurance coverage plans available, like obligation, complete, and also collision insurance coverage, to guarantee that you possess the needed security in location.

Examining Your Coverage Requirements

When it concerns evaluating your coverage needs to have for car insurance in Dallas, it is actually crucial to take into consideration a handful of essential aspects. To start with, examine the worth of your vehicle and exactly how a lot coverage you would certainly need to have in scenario of a collision or even fraud. Determine if you require thorough protection, crash protection, or even simply liability insurance based on your vehicle's worth and your finances.

Additionally, think of your steering habits and the danger aspects linked with the roads you regularly travel on in Dallas. If you have a long commute or usually drive in high-traffic areas, you might intend to go for insurance coverage that features kerbside aid or even rental car repayment. Understanding your driving patterns can aid you select the correct amount of insurance coverage to effectively defend yourself and also your vehicle.

Recognizing Different Forms Of Car Insurance

When it involves picking car insurance in Dallas, it is actually important to recognize the different forms of policies available. Liability insurance policy is a legal criteria and also deals with damages and traumas induced to others in a mishap where you are actually at negligence. It usually includes both physical accident responsibility and also residential property harm liability insurance coverage.

Another usual kind of car insurance is actually accident insurance coverage, which helps purchase fixings to your own vehicle after a wreck with an additional car or even object. Comprehensive insurance coverage, meanwhile, secures versus problems to your car that are not an outcome of a collision, like burglary, vandalism, or all-natural calamities. Comprehending these different policy options can aid you decide on the coverage that greatest matches your demands and also spending plan.

Investigating Insurance Coverage Companies in Dallas

When researching insurance service providers in Dallas, it is actually important to think about a few vital factors to guarantee you opt for a dependable and also trustworthy provider. Beginning by inspecting the financial security of the insurance company. A monetarily sound company is going to have the capacity to meet its obligations to policyholders, especially in the course of opportunities of insurance claims.

Next off, explore the client service track record of the insurance coverage companies you are actually thinking about. Good client assessments and also rankings can give you understanding into how the firm handles claims, questions, as well as overall customer contentment. Furthermore, looking into the provider's response opportunity and performance in handling cases can easily assist you determine their degree of solution.

Contrasting Quotes coming from Several Insurance Providers

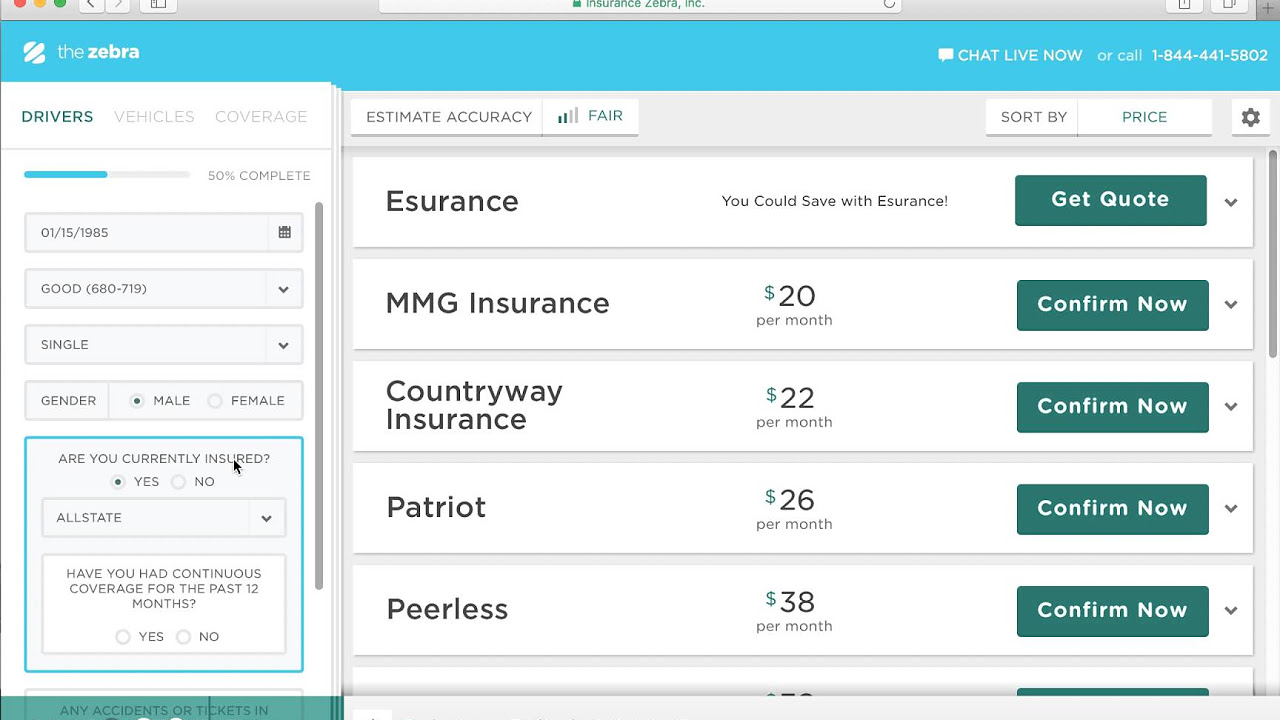

When comparing quotes coming from various insurance provider in Dallas, it is actually crucial to look at certainly not merely the cost yet also the coverage each policy gives. Make the effort to meticulously review the information of each quote, consisting of the deductible volume, plan restrictions, as well as any sort of added perks or rebates supplied.

Additionally, think about the image and financial reliability of the insurance provider. Try to find reviews and rankings from previous and existing customers to determine their level of customer satisfaction and also integrity. Through reviewing quotes from several insurance provider in Dallas, you can make an enlightened decision that satisfies your coverage necessities as well as finances constraints.

Assessing Consumer Customer Reviews as well as Rankings

When taking into consideration various car insurance policy alternatives in Dallas, evaluating client evaluations and also rankings can easily offer important understandings right into the quality of service supplied through insurance policy providers. These customer reviews are frequently composed by individuals that possess original experience managing the firm, producing all of them a dependable source of details for potential consumers. Through putting in the time to review consumer comments, you may gain a much better understanding of the business's credibility, customer support, as well as claims methods.

Positive customer reviews that highlight swift insurance claim settlement deals, valuable client service reps, and also total complete satisfaction along with the insurance coverage can show a trustworthy and also reputable insurance coverage provider. On the contrary, adverse testimonials that state challenges with claim processing, unresponsive consumer company, or even issues along with plan coverage may work as indicator to avoid specific insurer. It is necessary to consider the total agreement of customer assessments and also scores to create an updated decision on which insurance coverage supplier is the greatest suitable for your demands as well as inclinations.

Checking out for Savings as well as Unique Provides

When shopping for car insurance in Dallas, it's vital to look for discounts and special deals that could possibly aid reduce your premium expenses. Many Insurance Navy Brokers insurance policy service providers give a variety of rebates including secure driver discount rates, multi-policy markdowns, great pupil discounts, and even more. Through benefiting from these deals, you may likely save a notable amount on your insurance policy costs.

It is vital to meticulously review the qualifications standards for each and every savings as well as special deal to make sure that you qualify. Some savings may demand you to possess a well-maintained driving file, put in protection attributes in your vehicle, or even bunch numerous insurance plan with the exact same supplier. By understanding the certain demands for each price cut, you can maximize your discounts as well as discover the most effective car insurance coverage that matches your budget plan as well as needs.

Examining Plan Restrictions and Deductibles

When examining plan limitations and also deductibles, it's vital to know just how they can impact your protection as well as expenditures in the unlikely event of an accident or various other covered incident. Policy limitations describe the max total an insurer will certainly pay for an insurance claim. It is actually important to choose restrictions that thoroughly secure you fiscally without being extremely pricey. Greater limitations commonly indicate much higher fees, however they can easily offer much better protection if you are ever before associated with an expensive incident.

Deductibles, however, stand for the volume you are actually called for to pay out just before your insurance policy coverage starts. Selecting a higher insurance deductible can easily decrease your premiums yet likewise indicates you are going to need to spend more expense before obtaining insurance policy advantages. It is essential to strike a balance in between a tax deductible you can easily pay for and a superior that matches your spending plan. Very carefully examining plan limits and deductibles makes sure that you have the ideal level of insurance coverage without being rippling off for insurance policy that you might not need to have.

Consulting with an Insurance Coverage Agent for Assistance

Seeking direction coming from an insurance coverage agent can be actually greatly valuable when it happens to navigating the complexities of car insurance policy in Dallas. An insurance agent can deliver tailored assistance tailored to your one-of-a-kind needs as well as situations. They have the know-how to explain the ins and outs of different insurance, assisting you know the coverage alternatives offered and the equivalent prices. By talking to an insurance agent, you can easily acquire important ideas that can aid you in creating a notified decision when deciding on a car insurance program.

Moreover, an insurance agent can assist you in evaluating your details insurance coverage requirements located on aspects including the make and design of your vehicle, your driving behaviors, and any kind of extra security you may need to have. They can easily clarify any sort of challenging conditions or conditions in insurance coverage, guaranteeing that you are entirely knowledgeable about what you are actually purchasing. By leveraging an insurance policy broker's expertise as well as expertise, you may streamline the procedure of securing car insurance policy as well as have tranquility of mind knowing that you have comprehensive coverage in place.

Making a Knowledgeable Decision on Your Car Insurance Coverage Planning

When it pertains to creating an updated selection on your car insurance strategy, it is vital to very carefully determine your insurance coverage demands as well as spending plan restrictions. Make the effort to review the different sorts of car insurance coverage offered in Dallas and think about which ones straighten finest with your steering habits and also way of life. Looking into insurance coverage service providers in Dallas is also an important step to ensure you are selecting a respectable firm along with a track report of outstanding client service and also asserts contentment.

Aside from looking into insurance companies, reviewing quotes coming from several business may assist you find the most competitive costs for the insurance coverage you need to have. Reviewing customer testimonials and scores may give idea into the adventures of other insurance policy holders and offer you a far better understanding of the degree of company you may count on. Inspecting for discounts and special promotions, and also evaluating policy limitations and also deductibles, are also essential consider choosing the ideal car insurance policy prepare for your demands. Consulting with an insurance coverage representative for assistance can use personalized referrals and also help you get through any type of complex policy particulars just before creating your decision.