Obtain the Lowest Car Insurance Rates in Dallas

Exactly How to Spare Amount Of Money on Car Insurance in Dallas

To conserve amount of money on car insurance policy in Dallas, it's necessary to look at several aspects that can easily aid reduce your costs. One effective technique to decrease expenses is through preserving a well-maintained driving document. By staying clear of crashes as well as web traffic infractions, insurance policy companies are actually more probable to give you lower costs. Furthermore, going for a higher deductible may likewise result in considerable savings on your monthly costs. It means paying for extra out of pocket in the occasion of a case, a greater insurance deductible can result in lesser insurance policy prices on the whole.

Another method to spare funds on car insurance in Dallas is actually to check out discounts that insurance providers might deliver. A lot of insurance companies offer price cuts for various factors like having multiple plans with the exact same business, being a really good student, or even finishing a protective driving program. Also, some insurer offer savings for security features mounted in your vehicle, including anti-theft gadgets or even air bags. By taking advantage of these markdowns, you may possibly lessen your car insurance costs while still keeping adequate insurance coverage for your steering necessities.

Variables That Affect Car Insurance Coverage Rates in Dallas

Elements that affect car insurance coverage prices in Dallas feature the driver's grow older, steering file, and also credit report. More youthful drivers under the grow older of 25 usually tend to deal with much higher costs because of their limited driving expertise as well as higher chance of accidents. Additionally, drivers along with poor driving records, including multiple exeeding the speed limit tickets or even incidents, may likewise view increased insurance coverage prices as they are actually looked at higher risk by insurance policy firms.

One more significant variable that may impact car insurance policy prices in Dallas is the kind of vehicle being actually insured. Luxury or even high-performance autos typically feature higher insurance coverage expenses reviewed to even more reasonable or even family-friendly vehicles. The make, style, and also year of the car may affect insurance coverage prices because of differing repair expenses as well as security attributes. Insurance coverage companies additionally think about the regularity of car frauds in Dallas when calculating premiums, as vehicles that are more susceptible to burglary might possess higher insurance policy prices.

Comparing Different Car Insurance Policy Suppliers in Dallas

When comparing various car insurance coverage companies in Dallas, it is necessary to take into consideration a variety of aspects to locate the very best insurance coverage that fits your needs. Start through assessing the monetary stability and reputation of each insurance coverage company. Check out client assessments and also ratings to determine the amount of contentment one of policyholders. Additionally, contrast the variety of insurance coverage choices each company uses and also analyze whether they align along with your details demands. This features taking into consideration deductibles, limits, and extra functions like roadside assistance or even rental car protection. By assessing these parts, you may make an updated choice when choosing a car insurance coverage carrier in Dallas.

One more critical element to take into consideration when reviewing car insurance policy companies in Dallas is the prices and price cuts available. While expense shouldn't be the single determining aspect, it's vital to ensure you are actually acquiring a competitive cost for the coverage supplied. Request quotes coming from several insurance provider as well as match up the premiums based upon the same protection limitations and deductibles to efficiently examine the rates variations. In addition, inquire about any kind of offered savings, such as safe driver motivations, bundling plans, or even commitment perks. Knowing the cost-saving options each insurance firm supplies may aid you get budget-friendly car insurance policy while preserving ample defense for your vehicle in Dallas.

Tips for Looking For Discounts on Car Insurance in Dallas

One reliable means to lessen your car insurance expenditures in Dallas is actually to seek out savings provided through insurance companies. Lots of insurance provider deliver different savings based upon elements such as your steering file, the protection features of your vehicle, and also your registration in certain associations. Through putting in the time to seek information regarding readily available discounts, you may be able to considerably reduce your insurance superiors.

Yet another suggestion for finding discounts on car insurance in Dallas is to look at bundling your policies with the exact same insurance carrier. Many insurer use price cuts to customers that obtain various forms of insurance, like auto as well as house owners insurance policy, coming from them. Through packing your policies with each other, you may have the capacity to conserve cash on each private plan, featuring your car insurance.

Knowing the Minimum Required Car Insurance Coverage Criteria in Dallas

The metropolitan area of Dallas, Texas, mandates particular minimum required car insurance policy requirements that all drivers should abide by. Recognizing these criteria is actually crucial for guaranteeing compliance with the rule as well as shielding oneself fiscally in the unlikely event of a crash. In Dallas, drivers are needed to carry liability insurance coverage that features a minimum of $30,000 for bodily personal injury per person, $60,000 for physical trauma per collision, and $25,000 for property harm.

Satisfying these minimal car insurance policy requirements in Dallas is actually essential to stay away from encountering lawful fines and prospective financial liabilities. Responsibility insurance assists cover the costs affiliated along with personal injuries or even loss suffered through others in a crash that you are actually found to be responsible for. Through having the compulsory minimum coverage in position, drivers in Dallas can steer officially when traveling while also protecting themselves versus unpredicted situations that might occur while driving.

The Relevance of Shopping Around for Car Insurance in Dallas

The value of purchasing around can certainly not be overstated when it happens to securing car insurance policy in Dallas. With the several insurance coverage service providers offered out there, putting in the time to compare costs and also insurance coverage alternatives may dramatically influence the total expense of your plan. By looking into a number of options, you increase the likelihood of finding a strategy that not merely meets your demands but likewise suits your budget.

Moreover, looking around for car insurance policy in Dallas allows you to reveal potential price cuts or even promotions that various carriers may deliver. By being practical in looking into different insurer, you may pinpoint chances to conserve money by means of exclusive deals or even packed solutions. The discounts and costs given by insurance coverage providers may differ dramatically, therefore taking the time to go shopping around is actually crucial to safeguarding an affordable but complete car insurance coverage policy in Insurance Navy Brokers Dallas.

Insurance coverage Popular Errors to Steer Clear Of When Trying To Find Car Insurance Coverage in Dallas

When looking for car insurance policy in Dallas, folks often create the oversight of solely centering on the price. While it is vital to locate a cost effective fee, it is actually every bit as important to take into consideration the insurance coverage as well as premium of service provided through the insurance company. Choosing the most affordable policy without bearing in mind the amount of coverage may trigger economic problems in case of a crash or even other unpredicted scenarios.

When appearing for car insurance coverage in Dallas is overlooking to evaluate their policy routinely, another typical error folks create. Scenarios including transferring to a brand new area, acquiring a brand new vehicle, or even including an adolescent driver to the policy can all impact insurance policy costs. Failing to update your insurance carrier regarding these adjustments can lead to poor insurance coverage or overlooked options for price cuts. It's important to every now and then reassess your insurance policy needs to have to ensure you are actually sufficiently protected at the most ideal possible price.

Taking Advantage Of Technology to Discover Economical Car Insurance Policy in Dallas

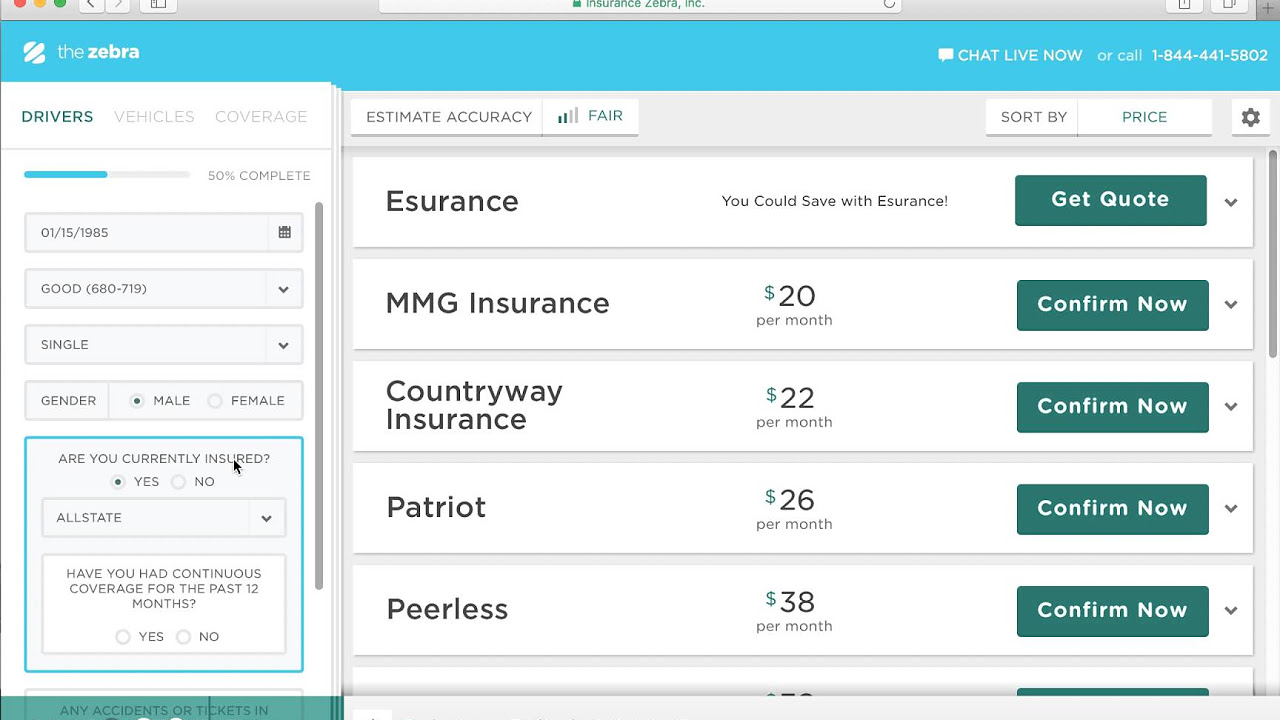

In today's digital grow older, innovation provides a plethora of resources and also information to help consumers find cost effective car insurance policy in Dallas. One such tool is actually on-line comparison web sites, where people can conveniently input their relevant information as well as receive quotes from various insurance suppliers. These platforms allow a simple and convenient technique to contrast rates as well as protection alternatives from numerous companies done in one location. By using these internet sources, drivers in Dallas can efficiently browse through the frequently complex landscape of car insurance as well as locate a plan that satisfies their necessities and spending plan.

Another technological improvement that can easily assist in discovering economical car insurance policy in Dallas is actually usage-based insurance programs. These programs make use of telematics gadgets or even smartphone apps to track drivers' behavior behind the tire, such as their rate, mileage, and stopping patterns. By displaying safe and secure steering routines, policyholders may be entitled for markdowns on their superiors. For drivers in Dallas seeking to conserve money on car insurance policy, these ingenious programs deliver a tailored strategy that awards accountable behavior when driving.

The Benefits of Packing Policies for Lower Car Insurance Coverage Fees in Dallas

Bundling policies may be a wise method to protect lesser car insurance policy rates in Dallas. By mixing your auto insurance plan along with other kinds of insurance coverage, such as home or even lessees insurance policy, you may be actually eligible for substantial discount rates. Insurer usually use special offers for customers that pick to pack their plans, making it an economical way to protect both your car as well as other beneficial assets.

Additionally, bundling plans can simplify the insurance coverage process, as you'll only need to cope with one insurance coverage provider for multiple policies. This can streamline interaction and also paperwork, and potentially conserve you opportunity and also problem when handling your insurance policy needs. In enhancement to potential price financial savings, packing policies for lower car insurance policy prices in Dallas uses the advantage of possessing all your insurance policy protection settled under one roof.

Looking For Specialist Advise for Finding the very best Car Insurance Policy Fees in Dallas

When trying to find the most ideal car insurance coverage rates in Dallas, looking for expert advice can be actually a wise decision. Insurance brokers or even brokers providing services for car insurance coverage can easily deliver important ideas and also access to a series of protection possibilities coming from various providers. These professionals are knowledgeable regarding the regional market and also may assist you navigate via the complexities of insurance coverage to discover one that matches your requirements as well as budget.